Since the start of 2022 the euro depreciated by some 15%, beginning the year at 1.14 USD per EUR and declining below parity towards 0.97 recently. One major factor causing this decline can be viewed as truly exogenous: the war in Ukraine was unexpected and resulted in several rounds of sanctions imposed on Russia, with sizeable negative repercussions on the EU’s export volumes and impairments for active foreign direct investment (FDI) of EU-firms in Russia. The EU received a second blow through rising energy prices. Many member countries showed a high dependence on Russian gas and oil, and the Russian government deliberately used its position to generate uncertainty in spot as well as futures gas markets leading to severe risk premiums after sanctions and countervailing measures by Russia were going back and forth. Due to its high dependence on Russian energy, the euro area suffered a set-back as a business location, making the euro area less attractive for passive FDI, destroying potential output, and finally leading to a depreciation of the euro vis-a-vis areas less exposed to Russia as a trade partner.

There is a second endogenous source for the devaluation of the euro, resulting from the build-up of inflationary pressure throughout the world economy, except Japan. The US-Federal Reserve Bank (Fed) was first confronted with rising inflation rates since in April 2021 (+4.2% YoY) while inflation in the euro area at that time still remained below target (+1.6% YoY). Both monetary authorities interpreted higher inflation rates as energy driven and transitory but by December 2021 the Fed changed its opinion and corrected its forward guidance from accommodative to restrictive. The Fed first announced to unwind its asset purchase program and started to increase the target rate by March 2022, while the ECB waited until the end of July 2022 to follow suit. By the end of September 2022 the target range for the US-interest rate reached 3% to 3.25% and the euro area‘s main refinancing rate was at 1.25%, creating an interest rate differential of almost 2 percentage points.

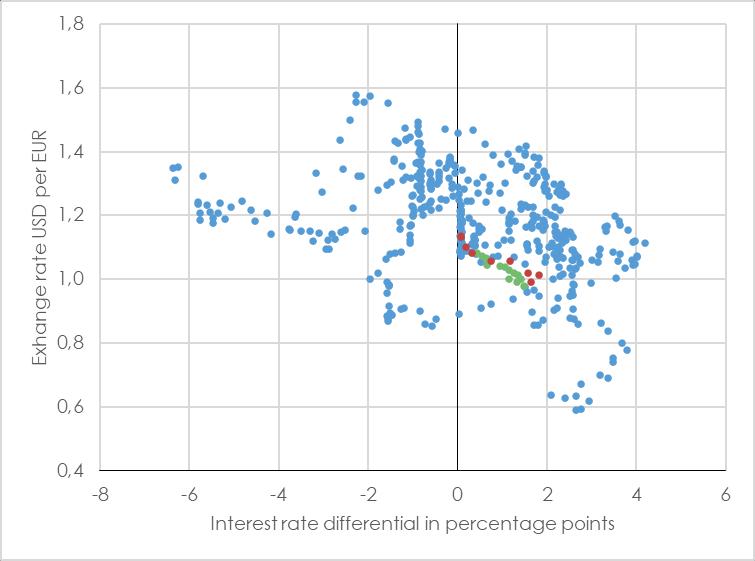

Deviations between US and European short term interest rates were a regular feature in the past. Figure 1 shows the interest rate differential between the US-target rate and the corresponding European equivalent from 1985 through 2022. A positive value on the horizontal axis implies that US-rates were above the main refinancing rate in the euro area. The vertical axis shows the exchange rate measured in USD per EUR. The slight negative slope of this cloud indicates that relatively high target rates in the US go along with a strong US-dollar, while a relatively high refinancing rate in the euro area typically involves a strong euro. The red dots in Figure 1 show the development from January to September 2022; the movement towards the lower right hand corner reflects the more aggressive policy stance in the USA together with the appreciation of the US-dollar.

Starting from this situation, what can we expect for the rest of 2022 and the following year? The WIFO forecast (Glocker – Ederer, 2022) expects a further tightening of monetary policy in both areas with the ECB acting more decisively such that the interest rate differential will be reduced to around 0.5 percentage points at the end of 2023. Accordingly, the euro will appreciate slightly (green dots in Figure 1), resulting in annual averages of 1.05 (2022) and 1.04 (2023) USD per euro with a trough in fall 2022. This development can be interpreted using the uncovered interest rate parity condition: after the US-monetary tightening, the USD must jump to a lower value (appreciation) in order to keep the interest parity condition valid, thus providing room for a consecutive depreciation which balances higher US-interest rates (Dornbusch, 1976). This adjustment mechanism does not hold empirically, however (Engel, 2014). A time-variable degree of asset market segmentation (Alvarez et al., 2009) or a liquidity premium on the deposit earning higher interest (Engel, 2016) provide alternative explanations.

Does the USD-EUR exchange rate actually jump around announcements dates of monetary policy actions? Figure 2 offers some insight. The lines in Figure 2 depict the exchange rate during the 10 business days before and after a monetary policy meeting, on which either the Fed (green) or the ECB (blue) announced a change in their target rate. To facilitate comparison, I norm the exchange rate for all episodes to unity at the day of the monetary policy announcement, thus a value of 1.02 indicates that the exchange rate was 2% above the level prevailing at the announcement date. The period runs from 16.3.2022, when the Fed published the first rate-hike through 21.9.2022, when the Fed increased the target range to 3% to 3.25%. Because both central banks explicitly use forward guidance, their moves appear to be somewhat expected. While the ECB does not seem able to move markets, the Fed announcements effectively make the dollar stronger, either at the date of the publication or even five to ten days ahead. Whether the ECB policy decision on 27.10.2022 includes some surprise element for the participants on the foreign exchange market, can be tracked in real time in Figure 2 over the next ten business days following the announcement date.

Finally, will there be consequences from the euro’s depreciation on the real economy? Probably price effects will dominate over the forecast horizon. A weaker euro implies higher import prices on intermediates, energy, consumer products, and tourism services in a period already plagued by inflationary strain. Such an environment makes it easier to pass-through higher import prices on to euro area customers. Positive wealth effects related to foreign USD-denominated portfolio investments by Europeans, however, will not compensate the price losses on international asset markets during 2022. Consequently, the potential positive effect on euro area consumption will remain limited. A cheaper euro will boost euro area exports, but at the same time weak foreign demand is likely to be the dominating force affecting international trade flows.

Author: Dr. Thomas Url

is Senior Economist at WIFO and has been working in the Research Group “Macroeconomics and European Economic Policy” since 1994. From 1999 to 2002 he was editor-in-chief of WIFO-Monatsberichte (WIFO Monthly Reports). He is an expert in the Austrian Fiscal Council, lecturer at the University of Vienna and head of the Working Group on Economic Statistics and National Accounts of the Austrian Statistical Society. He works on issues of risk diversification, funded pensions, the European Monetary Union and econometric applications in the field of macroeconomics.